Payroll Deductions

How do I make changes to my W-4 (payroll withholding) in Workday?

- Login to Workday

- Select the Pay app

- On the left-hand column select Withholding Elections

- Choose from the federal or state tabs depending on the changes you would like to make

- Select Update to make changes

- Once the updates have been made, select Ok to submit the changes

If you are an employee of BYU-Idaho and OLL Services (Online) a W-4 will need to be filled out for BYU-Idaho and OLL. Under the Withholding Elections there will be an option to update your BYU-Idaho W-4 and OLL W-4 under the federal and state tabs.

Special instructions for International Students (Non-resident Alien)

A nonresident alien may claim only “single or married filing separately” filing status on the federal form W-4 under marital status, even if they are married. No dependent amount is claimed. Do not mark exempt. However, do check the “Nonresident Alien box.”

How are tax deduction amounts determined?

Federal and state tax deductions are based on the W-4 elections that you select in Workday, the amount of money that you make each pay period, and the federal or state tax tables that are built into Workday.

If you have had no federal and state taxes deducted, you have probably not made enough in the pay period to have taxes withheld.

Tax items specific to students

OASDI (Social Security) and Medicare taxes are waived for student employees who are working on a university campus and have 6 or more credit hours per the IRS. If a student employee is working during an off-track or has less than 6 credits, then OASDI and Medicare taxes are deducted.

Where can I go for help in setting up my W-4?

We are not tax professionals and cannot give you tax advice. Below is a resource that may be useful.

- Login to Workday

- Select the Pay app

- On the left-hand column select IRS W-4 Tax Withholding Calculator

Address Change

How do I change my address and other contact information in Workday?

- BYU-I Employees (non-student):

- In Workday select your profile in the upper right-hand corner of the screen

- Select View Profile

- Select Contact on the left-hand side of the screen

- Select Edit at the top of the screen to update your home and work address and other contact information

- Select Submit to save changes

Note: If you are no longer working for BYU-Idaho, please contact the payroll office for a change of mailing address at payroll@byui.edu. All terminated employee W-2s will be mailed.

- BYU-I Student Employees: (For international student address changes, please see below)

- Log on to the BYU-Idaho homepage (byui.edu)

- Select your profile picture in the upper right-hand corner and a drop-down menu will appear, and then select “View Profile.”

- Next select the “Edit Personal Information” button. You will then be redirected to the old website. Follow the instructions below.

- Click on the profile tab, located along the top of the page – if you do not see the profile tab click on the more tab first

- Under the addresses tab, verify that the mail address listed is your local mailing address where you would like to receive any correspondence and paychecks that may need mailed out while at BYU-Idaho. Please make sure to include the complete address, including apartment number.

- ***Please note that when you leave the university, you will need to change this address to your permanent home address, where you would like your W-2 to be mailed.

If you have questions, please contact the records office in the Kimball building ext. 1000 or at registrar@byui.edu.

- BYU-I International Students:

- International students can update their home address (local Rexburg mailing address) in Workday by contacting human resources or can send the updated address to payroll@byui.edu.

- OLL (Online) Employees

- In Workday select your profile in the upper right-hand corner of the screen

- Select View Profile

- Select Contact on the left-hand side of the screen

- Select Edit at the top of the screen to update your home and work address and other contact information

- Select Submit to save changes

If you are an OLL employee and have had a state change in the current year, please contact the payroll office immediately payroll@byui.edu or 208-496-1990.

If you are no longer working for OLL Services, please contact the payroll office for a change of address at payroll@byui.edu.

Payments and Payslips

Where was my direct deposit or check sent and how do I get my pay slip?

- In Workday select the Pay app

- On the left-hand side, select Pay and then Payments

- Scroll to the bottom of the page to see pay slips.

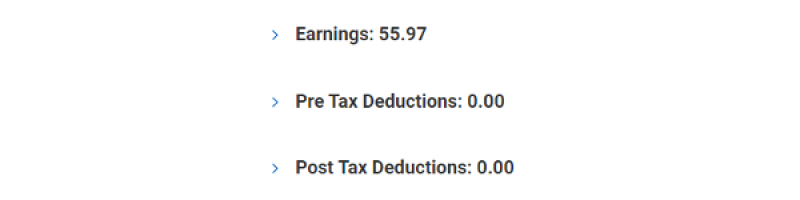

Pay slips are available digitally in Workday for payrolls that began in 2016. For pay information prior to 2016, the payroll office will need to be contacted at payroll@byui.edu. Workday pays slips are available as soon as payroll has been processed, usually two days prior to the pay date. There are two different views available – view (more detailed) and print. The pay slips show detailed information regarding hours worked, gross pay, deductions, net pay, vacation, sick leave, other leaves, employer-paid benefits, withholding status, and year-to-date information. The bottom of the pay slip shows if your payment was a check or direct deposited into your bank account.

W-2s

When are W-2’s available?

W2’s will be available by January 31st of the year following the year that you worked.

How do I access my W-2 in Workday?

- In Workday, select the Pay app

- Select My Tax Documents

A paper copy of your W-2 will also be mailed to the Workday address you have listed unless you elect to only receive your W-2 electronically in Workday. If you would like to elect to receive only an electronic copy and not have your W-2 mailed, follow these steps:

- In Workday, select the Pay App

- Select My Tax Documents

- Under printing election select edit

- Select the election you would like to make

- Select Ok to submit the change

All terminated employee W-2s will be mailed.

Payment Elections (Direct Deposit)

Add Bank Account (Initial Setup)

- Login to Workday

- Select the Pay app from the main menu

- Select Payment Elections

- Select Add button

- Complete all the required fields

- Select OK to save updates

If you are a student employee moving to a regular BYU-I employee position, look at the bottom of the payment elections page - payment elections requiring setup - add regular payment information.

Payment Elections

- Login to Workday

- Select the Pay app from the main menu

- Select Payment Elections

- Under the payment elections section, select Edit under the different payment election lines (expense, student, regular payments). Payment elections cannot be modified until at least one bank account has been listed above.

- Select OK to save updates

Edit/Add Account

- Login to Workday

- Select the Pay app from the main menu

- Select Payment Elections

- Select Edit under the bank account you have previously listed or

- Select Add - This step is only necessary if you want to add additional bank accounts

- Complete all the required fields

- Select OK to save updates

If you are deleting an account, you must change the election first so that account is not tied to a payment.

Late Time Entries

What do I do if I need to make a late time entry?

After the bi-weekly pay period ends, it will be locked on Monday at 12 pm. Once locked, employees cannot enter time into the pay period. If an employee needs to submit additional time after the pay period is locked, the employee will need to email their manager with the hours missed – showing the employee’s full name, I-number, the date(s) worked, and the times clocked in and out. The manager needs to review the late payroll information for accuracy and then forward the email to payroll@byui.edu. The payroll team will then enter those hours into Workday and submit them for approval to the employee’s manager. Once the late time is approved, payment will be made to the employee. The payment may occur on the current payroll pay date, on the next payroll pay date, or on another date, depending on the circumstance.

Payroll Schedule

What are the payroll schedules?

Pay periods occur every two weeks for bi-weekly employees. All payroll payments for two-week pay periods will be distributed the next Friday after the last working day of the pay period.

Pay periods occur two times a month for semi-monthly employees. The semi-monthly pay periods are as follows 1st – 15th and 16th – the last day of the month. Payments are made on the 8th and 23rd of the month.

If the pay date falls on a weekend, then payroll will be paid the Friday before the weekend. If the pay date falls on a holiday, then payroll will be paid on the last business day before the holiday begins.

Model My Pay

Workday has a function called Model My Pay that allows employees to estimate their pay after applying hypothetical changes. This function gives you an opportunity to see how changing tax elections, insurance, 401K plans, or a pay raise can affect your take home pay.

DISCLAIMER: This will NOT make changes to your current pay and is for viewing and planning purposes only. These estimates may not reflect the actual changes to your pay.

Where to find Model My Pay in Workday

- In Workday, under Your Top Apps menu choose the Pay app. Then on the left hand-side under Suggested Links choose Model My Pay.

- If you have more than one position, choose the position that you would like to test.

- Choose a payment date without holiday, vacation, or sick pay. This will give a more accurate earnings estimate.

How to Navigate Model My Pay

Please note you can make all the tax and earnings estimates listed below before selecting Model at the bottom of the page to see your estimated pay results.

Adjust Federal Taxes

To make estimated changes to your federal taxes go to the bottom of the webpage and select Adjust Federal Taxes.

After you have made your estimated federal tax adjustments be sure to select Adjust at the bottom of the page.

Adjust State Taxes

To make estimated changes to your state taxes go to the bottom of the webpage and select Adjust State Taxes.

For Idaho employees working on campus make sure that your work state is set to Idaho.

When selecting the home state, online adjunct faculty employees can see how moving to a different state than the one they currently reside in will affect their pay.

After you have made your estimated state tax adjustments be sure to select Adjust at the bottom of the page.

Earnings and Tax Adjustments

To make changes to your earnings (pay raise) and tax deductions – click on the blue arrows next to the following items listed below to expand the details. Then, enter the estimated changes in the adjusted value column.

Model My Pay Comparison

Once you have made all the desired estimated tax and earnings adjustments select Model at the bottom of the page to see your results. You will then be shown your Reference Pay (current pay) compared to your Modeled Pay (estimated pay). From here if you want to make additional changes you can select the orange – Rerun Model My Pay button.

If you have questions, please contact payroll at 496-1990 or email payroll@byui.edu.