What is FAFSA?

FAFSA is the Free Application for Federal Student Aid.

- FAFSA determines your eligibility for Federal Pell Grants and Federal Loans.

- FAFSA is required for evaluation for the BYU-Idaho Need-Based scholarship.

- FAFSA is used by businesses and the state to evaluate scholarships like the Idaho Opportunity Scholarship.

How do I Apply for FAFSA

Create an FSA ID at studentaid.gov.

- Your parent or spouse may also need an FSA ID to complete their portion of the FAFSA and give permission for their tax information to be used.

- Complete the FAFSA form at studentaid.gov.

- Enter BYU-Idaho's school code: 001625

- Submit your FAFSA before the priority deadline to be ready for the semester.

You can still receive federal aid if you submit after the priority deadline, it just might not be here before late fees apply

How to Fill Out the Free Application for Federal Student Aid (FAFSA) Form.

View BYU-Idaho's FAFSA priority deadlines.

FAFSA Aid Options and Eligibility for BYU-Idaho Students

What aid is offered through the FAFSA?

- Federal Pell Grants

- Federal Direct Loans (Subsidized and Unsubsidized)

Basic eligibility requirements:

- U.S. citizens or eligible non-citizen status

- Valid Social Security number (Make sure this is correct on your BYUI Profile as well)

- Have completed a high school diploma or its equivalent

- Enrollment or acceptance in an eligible degree program

- Maintain satisfactory academic progress

- No defaults on federal student loans

FAFSA Verification Process: What BYU-Idaho Students Need to Know

- The Department of Education selects some students (about 1/3) to verify their information.

- If selected, you'll need to provide additional documentation to the financial aid office.

- Verification ensures the accuracy of FAFSA information.

- Federal Aid cannot be disbursed until verification is complete.

Learn about the verification process

Once you have applied – Remember these three secrets to getting and keeping your aid:

1. Enroll in Program Applicable Classes

- BYU-Idaho provides the Program Applicability Tool (PAT) to check your classes.

- Only classes for your declared major count for federal aid.

- Each credit will determine your eligibility.

Learn About Program Applicability

2. Understand the Financial Aid Determination Date (FADD)

What is FADD?

- The date when we check your enrollment for aid eligibility.

- The FADD is the 23th day of the semester or when it is determined the student has a valid FAFSA, whichever is later.

Why does it matter?

- Your aid is based on your enrollment in Program Applicable credits at FADD.

3. Maintain Satisfactory Academic Progress (SAP) Standards

To maintain federal aid eligibility you must

- Have a 2.0 Cumulative GPA

- Complete 67% of all the classes you attempt

Other important things to remember

Repeated Coursework

- You may only receive aid for a program applicable class one time after you have already received a passing grade (D- or higher) in the class.

Remedial Coursework

Federal financial aid may be awarded for four remedial courses offered by the university:

- ENG 106

- ENG 109

- MATH 100B

- MATH 101

FAFSA Simplification and Changes for 2024-2025 FAFSA

Changes to the 2024-2025 FAFSA application include:

- Fewer questions to answer.

- All contributors (you, your spouse, your parents or stepparent) to your FAFSA must give consent for Direct Data Retrieval to transfer tax information automatically from the IRS.

- Changes to asset reporting for small business owners, family farms, and child support.

- The number of household members in college will continue to be asked but will not factor into calculations.

- Unborn children can no longer be included in household size.

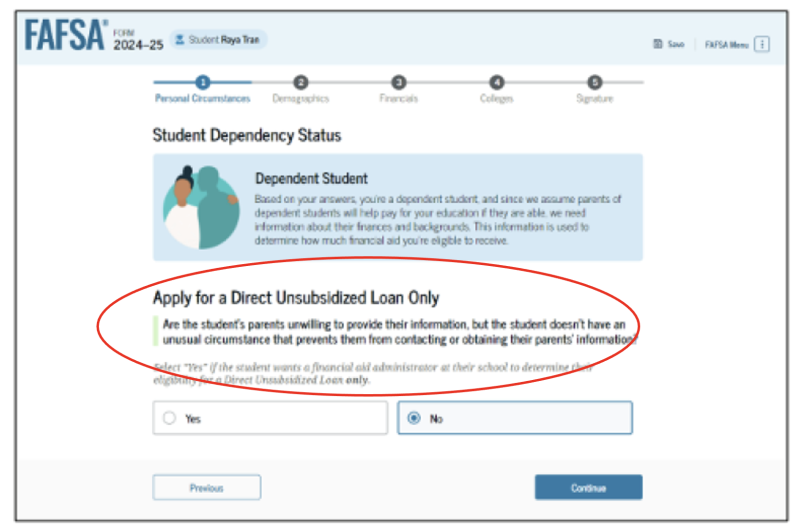

The question shown above is from the 2024-2025 FAFSA and can be confusing to Dependent students.

- By marking “yes” a student is indicating that their parents refuse to provide their information on the FAFSA. Without parent information, a student is only eligible for a Direct Unsubsidized loan. Marking “yes” on this question will bypass all other questions about your parents and provide eligibility only for an unsubsidized loan.

- Be sure to mark “No” and provide your parent's information if you want to be considered for Pell Grant and Federal Direct Subsidized Loans.

Provisionally Independent Status

If you mark on the FAFSA that you are

- Unaccompanied and homeless,

- Self-supporting and at risk of being homeless, or

- Unable to provide parent information on the FAFSA,

Here is what happens:

- You will receive a “provisionally independent status” and an SAI which will be used to determine how much financial aid you are eligible to receive.

- Then you will need to provide proof of your situation to the financial aid office.

- Check our petitions website for more details.

- If your proof is accepted:

- You’ll be considered an independent student.

- If your proof is not accepted:

- You’ll be considered a dependent student.

- You’ll need to update your FAFSA with your parent’s information.

For more on FAFSA changes, visit studentaid.gov.

FAFSA 2025–2026 Launch

When will the 2025-2026 FAFSA be launched?

The 2025-2026 FAFSA Application is now open.

When should I complete my application?

- Remember, this application is for the Summer 2025 term and Fall 2025, Winter 2026, and Spring 2026 semesters, so complete it before the priority deadline for the first semester you will attend.

- The BYU-Idaho Need-Based Scholarship will give priority consideration to students who have completed their 2025-2026 FAFSA application by March 1.

Is the 2025-2026 FAFSA application different from the 2024-2025 FAFSA?

- No, the 2024-2025 application was revamped to simplify the process for families, but the 2025-2026 application is the same as 2024-2025.

BYU-Idaho FAFSA Help: Contact Financial Aid Office

Need assistance? Contact the BYU-Idaho Financial Aid Office:

- Email: financialaid@byui.edu

- Visit: Kimball 196

- Livechat: ask to speak with a financial aid specialist using the chat bubble on any BYU-Idaho webpage

Complete your FAFSA today to start your journey towards financial aid at BYU-Idaho.

For any more questions, check out our FAFSA FAQ.